Optimal Execution Algorithms For High Frequency Trading:imi-iisc

The human body is incapable of reacting promptly to capitalise on a price motion that lasts for a couple of milliseconds. The terms algorithmic buying and selling and high-frequency trading could additionally be used interchangeably by traders while colloquially discussing a relevant topic. Nevertheless, from the above paragraphs, you realize https://alignersteps.com/2023/09/06/the-way-to-begin-foreign-foreign-money-trading-a/ that HFT is a branch of algorithmic buying and selling.

Regardless of the chosen frequency, algo buying and selling requires careful planning, strong threat administration, and steady monitoring. Merchants should keep abreast of market developments, refine their strategies, and adapt to altering situations. By understanding the different varieties of algo trading based on frequency and their respective characteristics, merchants can select the method that best aligns with their objectives and risk tolerance. Algorithmic buying and selling refers to the usage of pc algorithms to automate trading selections and executions in financial markets. Factor investing is an approach that targets securities with distinct attributes corresponding to value, quality, momentum, size, and minimum volatility. These traits, generally identified as components, are enduring and well-studied features that help traders decipher variations in anticipated returns.

At the identical time, this house is getting so competitive amongst institutions in the developed markets that may afford the conditions that immense assets go in course of improving the algorithm. Moreover, analysis has proven that news from online social media can present early indicators of changes in financial and industrial indicators. The inclusion of sentiment evaluation as a short-term factor provides a model new perspective for investors, who historically depend on value and quantity for predicting returns. The quickly positioned and canceled orders cause market knowledge feeds that ordinary investors rely on to delay price quotes whereas the stuffing is going on. HFT firms benefit from proprietary, higher-capacity feeds and probably the most succesful, lowest latency infrastructure. Researchers confirmed high-frequency traders are in a position to revenue by the artificially induced latencies and arbitrage alternatives https://www.xcritical.in/ that end result from quote stuffing.

Stay Efficiency

The sentiment analysis trading strategy includes leveraging crowd reactions and the analysis of unstructured knowledge, similar to news articles and social posts, to foretell short-term value changes and profit from market movements. This technique makes use of advancements in laptop natural language processing and understanding to assign sentiment scores to news objects, which can be utilized as directional signals for buying and selling selections. Quantitative hedge funds and other traders have included sentiment analysis into their methods to realize an edge out there.

Exploring Hft (high Frequency Trading): Risks And Rewards

This sort of trading is much like scalping trading where traders take advantage of the small window or buying and selling alternatives when the path of value for an asset varies even the slightest. The big distinction between scalping and HFT is the big quantity of transactions and the usage of advanced algorithms to identify buying and selling alternatives and execute them in seconds or milliseconds to maximise revenue potential. HFT methods depend on the use of superior know-how to analyse giant volumes of market data, establish patterns, and execute trades automatically.

Why Building Buying And Selling Systems In India Simply Received 10x…

High-frequency buying and selling is used by monetary establishments, hedge funds, and massive traders to get an edge in the market and earn cash. We have come a good distance when it comes to investor participation in monetary high frequency trading markets in India. Not only has the number of retail investors increased, however the way in which they participate has also drastically changed. From phoning brokers to placing orders, the introduction of Demat accounts has helped us place orders with a few clicks.

- High-Frequency Trading (HFT) and algorithmic buying and selling (algo trading) are related ideas, but there are some distinctions between the two.

- These trading algorithms leverage advanced mathematical models and vast quantities of historic knowledge to identify worthwhile trading alternatives and execute trades efficiently.

- Risk Disclosure – Futures buying and selling incorporates substantial danger and is not for every investor.

- These traits, generally identified as components, are enduring and well-studied options that help traders decipher variations in anticipated returns.

- It is usually configured to ensure minimal latency, as the system usually co-locates services the place the trading servers are additionally positioned, which minimises further delays.

Kinds Of Algo Buying And Selling Methods

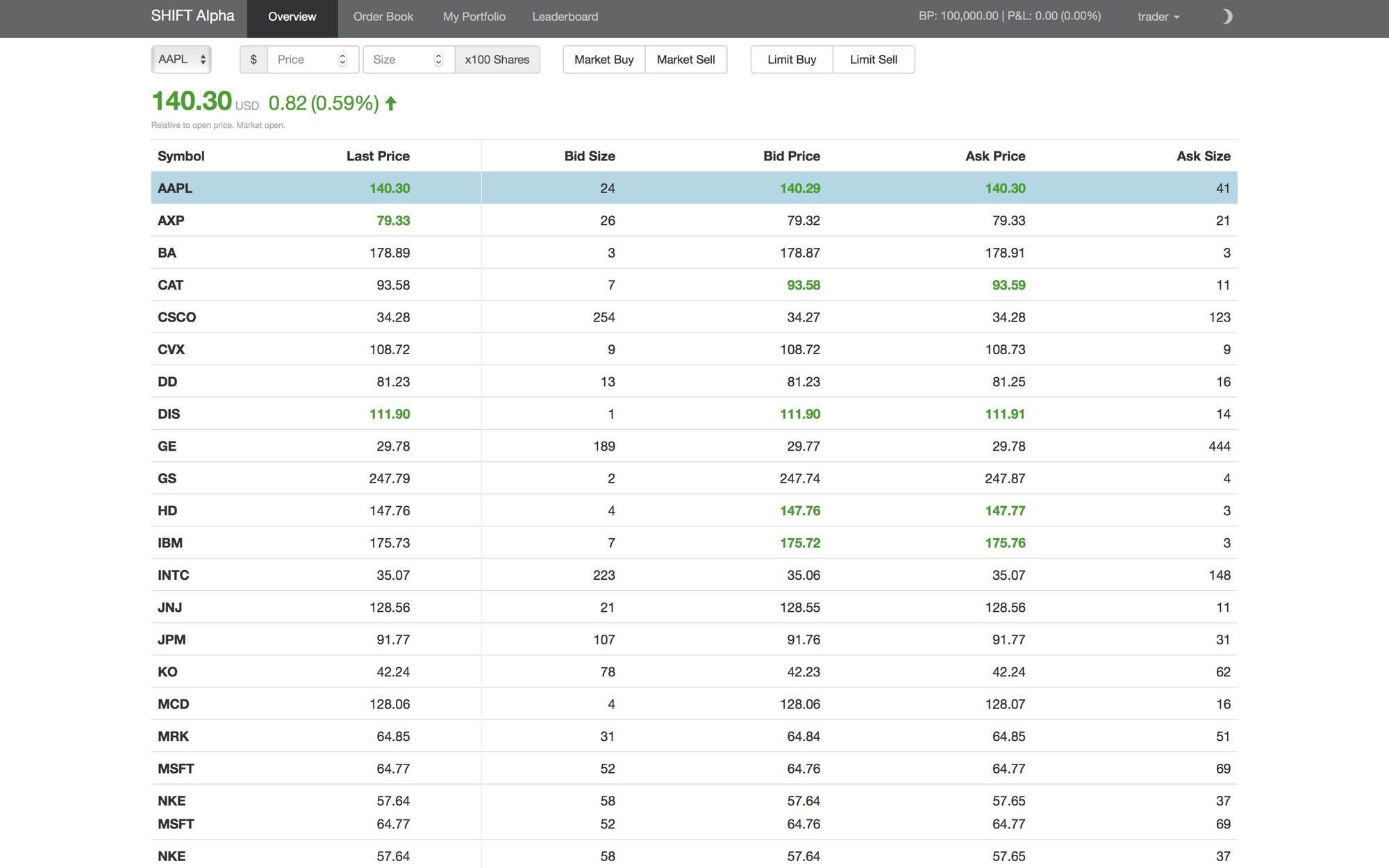

By constantly being willing to purchase Digital asset or sell, they guarantee a liquid market and revenue from the bid-ask spread. In India, algorithmic trading is within the initial phases of its progress phases, as it is principally the institutions that carry out algo-trading. Nevertheless, in developed economies like the Usa, it is estimated that greater than a 3rd of orders are positioned by laptop algorithms. Each markets are expected to see the number of algo-traders improve, albeit the previous is more likely to see quicker progress than the latter. In India, we have share brokers like Share India attempting to propagate algo trading solutions within the retail phase. HFT makes it possible for traders to make profits on even the slightest motion of the asset’s price.

HFT creates opportunities for arbitrage by capitalising on short-lived price differentials between associated property or throughout completely different markets, enabling merchants to revenue from market inefficiencies. Medium-frequency trading occupies the middle floor between high and low-frequency trading. Trades are executed with a frequency that falls between the rapid-fire tempo of HFT and the longer holding periods of low-frequency trading. Medium-frequency buying and selling methods can vary extensively, relying on the specific goals and timeframes of the trader. Issue investing is an funding technique the place securities are chosen based mostly on specific attributes that have been identified as key drivers of returns.